|

Image: Business Insider Illustration, Wikipedia |

With things going the way they are, a lot of people are talking about big history in action, whether it’s the breakup of the Eurozone, or the simultaneous market/economic/political spasm happening in the US.

Today Paul Krugman reminds us once again that this could be 1937 all over again.

Simon Johnson thinks it could be even worse: The long depression of the 1870s all over again.

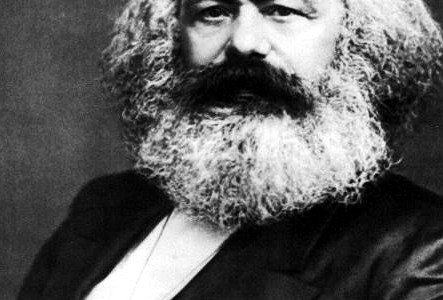

Recently Nouriel Roubini got a lot of attention for saying that Marx basically got the battle between labor and capital correct, and that capitalism itself now stood on the brink of collapse.

And even on Wall Street…

UBS’ George Magnus has a big piece out on political economy favorably quoting Karl Marx:

“At a certain stage of development, the material productive forces of society come into conflict with the existing relations of production or – this merely expresses the same thing in legal terms – with the property relations within this framework of which they have operated hitherto”.

Preface to A Contribution to the Critique of Political Economy, Karl Marx (1859)

In ‘The Return of Political Economy’ (Economic Insights, 5th February 2010), I wanted to emphasize how, in the wake of the financial and economic crisis of 2008-09, the interaction between political and economic decision-making would come to play an increasingly significant role in the determination of economic, and market outcomes. Looking at the time at the complicated legacy of de-

leveraging in developed markets, the embryo of the sovereign debt crisis, especially in Europe, and growing social and economic contradictions in China, it was possible to imagine, if not predict precisely, pretty much what we see playing out today.

Now you don’t have to be a member of the Socialist International to recognize that Marx’s words above have contemporary relevance. For him, post-feudal ‘conflict’ would lead to social revolution and the overthrow of bourgeois society, but we know different, not least because the Western model of economic development overhauled and democratised the concept of ‘ownership’ (of the

means of production). Nevertheless, the old guy was a pretty shrewd analyst,

learned a lot about political economy from likes of Adam Smith and David Ricardo among others, and offered some still relevant insights into how and why things happen in the economy and society.

The quote above captures the important idea of conflict or turbulence when events happen that lead to challenges to the power, authority and legitimacy of the existing political and economic order. During the last several months, we have seen a succession of such challenges in the Eurozone, the US, and even, in embryonic form, in China. The recent skittishness in financial markets and increase in risk premiums reflect not only a rise in anxiety about the deteriorating health of the global economy, but the draining of confidence that political elites are up to the task of addressing it.

This note, then, considers the existential crisis in the Eurozone, ‘deficit attention disorder’ in the US and other advanced economies, and China’s current political economy, for which the recent high-speed rail accident serves as an interesting metaphor.

Again, you know it’s a real panic when everyone’s trotting out the old guys, and even capitalists think Marx got the endgame right.